- Used to fight a recession

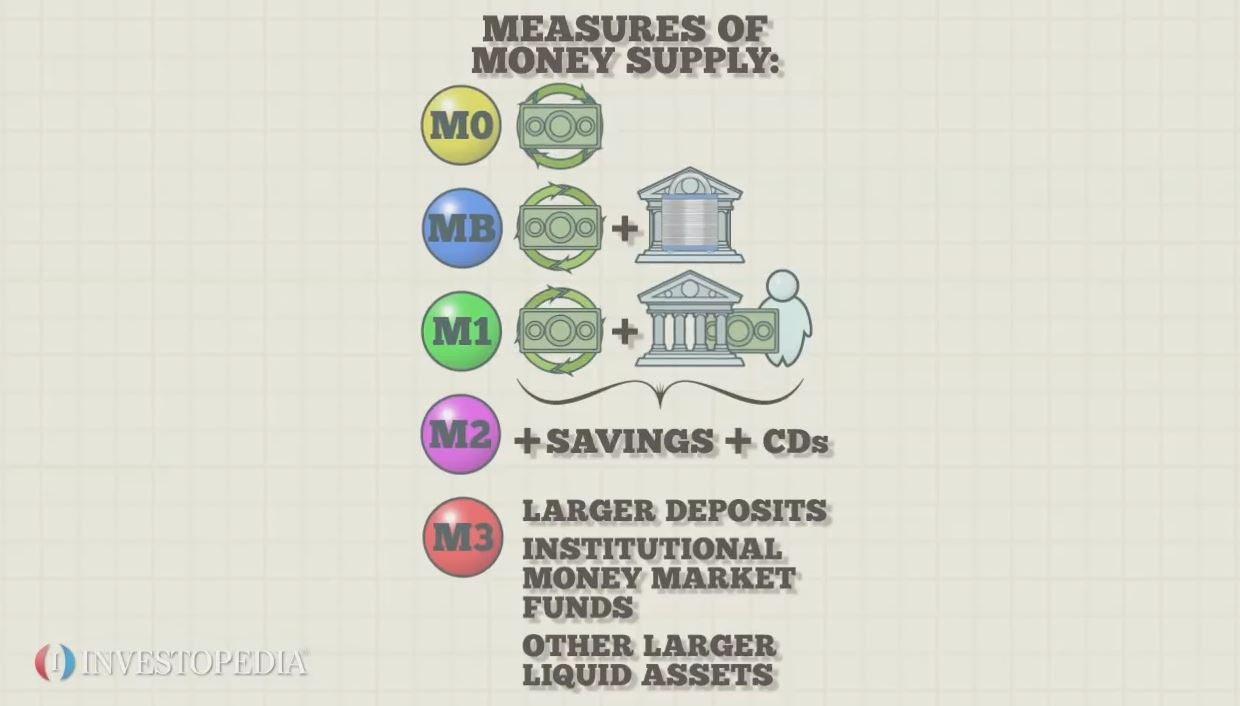

- Open market operation consists of buying bonds, which increases money supply

- Discount rate decreases

- Reserve requirement decreases

- Taxes decrease

- Government spending increases

- There will be a budget deficit

- Consumption and Government Spending increases

- Aggregate Demand increases

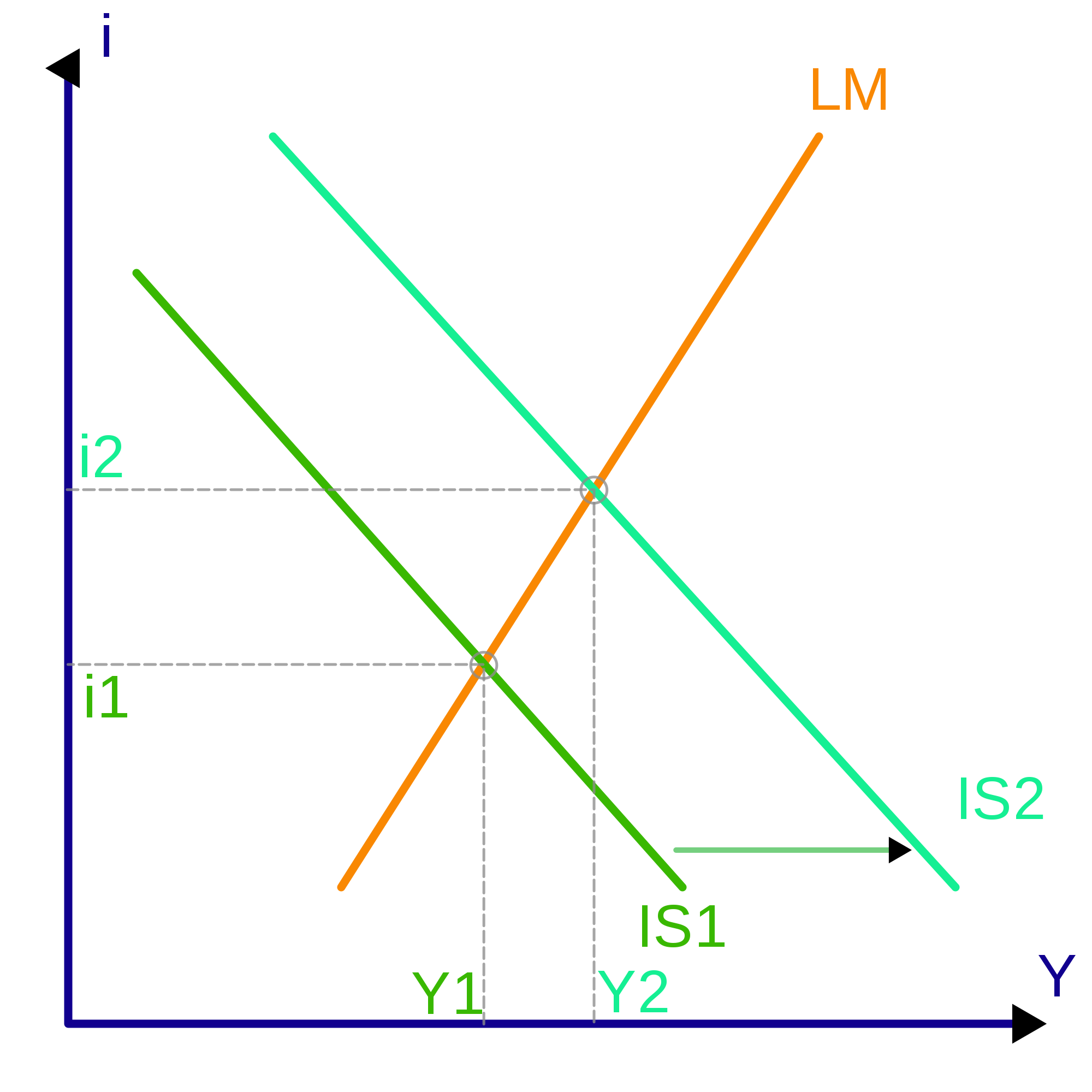

- Demand for money increases

- Interest rate increases

- Gross Domestic Private Investment decreases

- Supply of loanable funds decreases

- Demand for loanable funds increases

Contractionary Policy (AKA "Tight Money Policy")

- Used to fight inflation

- Open market operation consists of selling bonds, which decreases money supply

- Discount rate increases

- Reserve requirement increases

- Taxes increase

- Government spending decreases

- There will be a budget surplus

- Consumption and Government Spending decreases

- Aggregate Demand decreases

- Demand for money decreases

- Interest rate decreases

- Gross Domestic Private Investment increases

- Supply of loanable funds increases

- Demand for loanable funds decreases

- Fiscal Policy is carried out by Congress and the President, and it usually has to do with taxing and spending

- Monetary Policy is carried out by the Federal Reserve Bank (the Fed), and it deals with open market operations, the discount rate, the federal fund rate and the reserve requirement

- Discount Rate - The interest rate that the Fed charges commercial banks for borrowing money

- The lower it is, the more banks borrow

- Federal Fund Rate - The interest rate that commercial banks charge one another for an overnight loan

- Bank reserves and money supply have a direct relationship with each other

- The Federal Fund Rate has an inverse relationship with the two in the previous bullet

- Prime Rate - The interest rate that banks charge their most credit-worthy customers