Disposable income and Multiplier's

Disposable Income (DI)

- Income after taxes or net income

- DI = Gross Income - Taxes

2 Choices

- With disposable income, households can either

- Consume (spend money on goods and services)

- Save (not spend money on goods and services)

Consumption

- Household spending

- The ability to consume is constrained by:

- The amount of disposable income

- The propensity to save

- Do households consume if DI = 0?

- Autonomous consumption

- Dissaving

- APC = C/DI = % DI that is spent

Saving

- Household NOT spending

- The ability to save is constrained by:

- The amount of DI

- The propensity to consume

- Do households save if DI = 0? No.

- APS = S/DI = % DI that is not spent

APC & APS

- APC + APS = 1

- 1 - APC = APS

- 1 - APS = APC

- APC > 1 : Dissaving

- - APS . Dissaving

MPC and MPS

- Marginal Propensity to Consume

- △C/△DI

- % of every extra dollar earned that is spent

- Marginal Propensity to Save

- △S/△DI

- % of every extra dollar earned that is saved

- MPC + MPS = 1

- 1 - MPC = MPS

- 1 - MPS = MPC

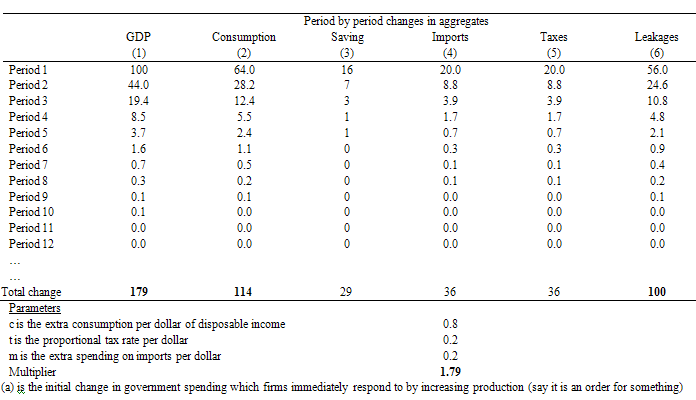

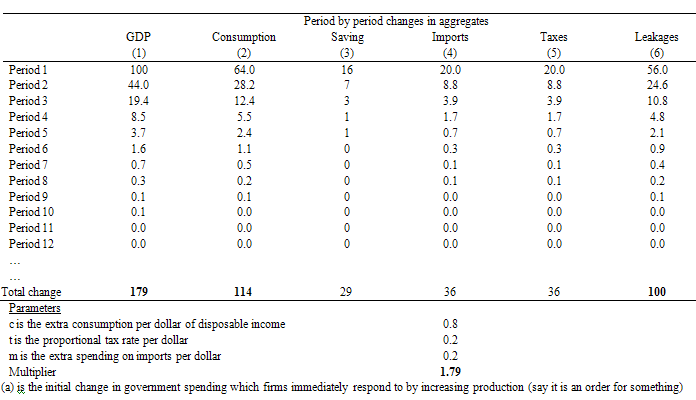

The Spending Multiplier Effect

- An initial change in spending (C, G, Ig, Xn) causes larger change in aggregate spending (or AD)

- Multiplier = △in AD/△in spending

- Multiplier = △in AD/△C, G, Ig, Xn

- Why does this happen?

- Expenditures and income flow continuously which then sets off a spending increase in the economy

- Can be calculated from MPC or MPS

- Multiplier = 1/1-MPC or 1/MPS

- Multipliers are + when there is an increase in spending and - when there is a decrease

Tax Multiplier

- When government taxes, multiplier works in reverse b/c money is leaving circular flow

- Tax Multiplier Formula (it's negative) = -MPC/1-MPC or -MPC/MPS

- If there is a tax CUT, multiplier is + because there is now more money in the circular flow

No comments:

Post a Comment