What is it? - A critique and flaw of Keynesian policies that are applied to fight a recession (an expansionary period).

Why does it happen? - The policy of cutting taxes and raising spending will create a budget deficit

- So, the budget deficit must be funded and to do this, Congress orders the sale of US bonds

- This money mostly comes from US citizens, companies and investment firms

- Therefore, money that could be spent on consumption or used for private savings is now being used to buy bonds

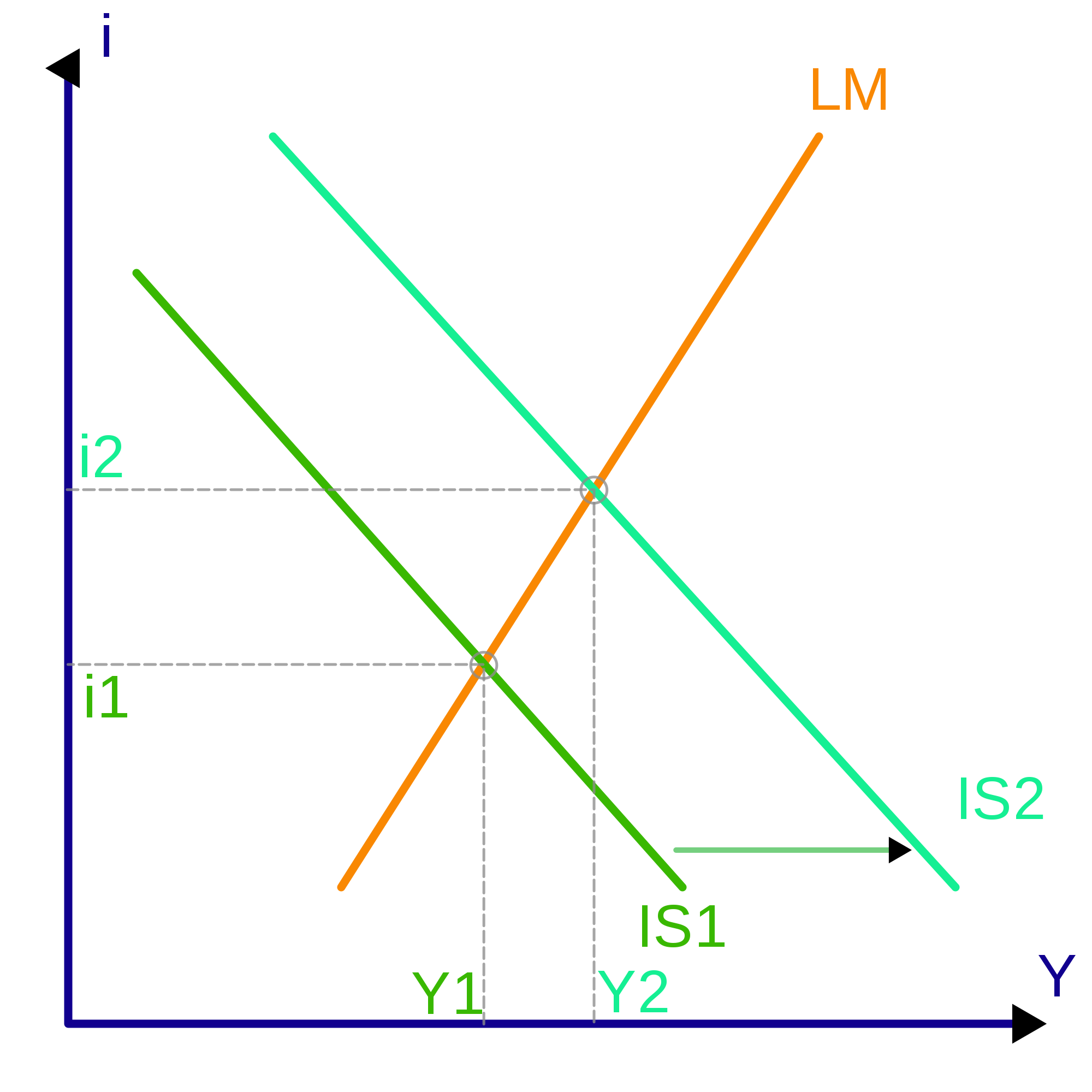

- On the Money Market, this will cause the money demand curve to shift outward. Remember, this is a fiscal event.

- On the Loanable Funds Market, this will cause the supply curve to shift inward because we are not saving money privately anymore. Also, this can cause the demand curve to shift outward because the private and public demand for money increases.

- On both graphs, the nominal and real interest rate will increase.

- Therefore, on the investment demand graph, the increase in nominal and real interest rates will cause Ig to decrease

- It's counterproductive, but it is done because Fiscal Policy supporters insist that gains in consumption and government spending will outweigh any loss in future Ig

No comments:

Post a Comment