The BALANCE of PAYMENTS

The Balance of Payments - Measure of money inflows and outflows between the U.S. and the rest of the world (ROW)

- Inflow = Credit

- Outflow = Debit

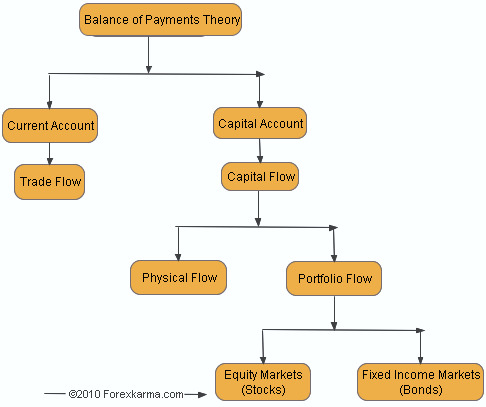

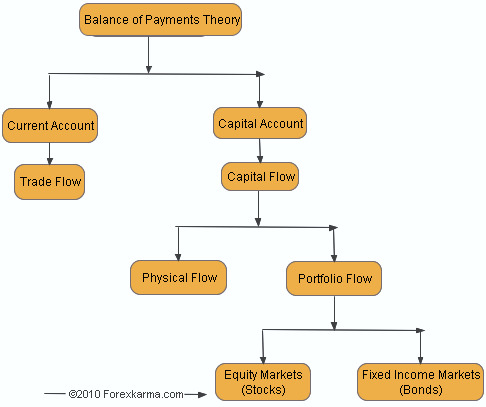

- Balance of payments is divided into 3 accounts

- Current account

- Capital/financial account

- Official reserves account

Double Entry Bookkeeping

- Every transaction in the balance of payments is recorded twice in accordance with standard accounting practice

- Ex. U.S. manufacturer, John Deere, exports $50 mil worth of farm equipment to Ireland

- Credit of $50 mil to current account

- (- (minus) $50 mil worth of equipment/assets)

- Debit of $50 mil to capital financial account

- (+ $50 mil worth of euros or financial assets

- The two transactions offset each other. Theoretically, the balance payments should always equal zero

Current Account

- Balance of Trade or Net Exports

- Exports of goods/services - import of goods/services

- Exports create a credit to BOP

- Imports create a debit to BOP

- Net Foreign Income

- Income earned by US owned foreign assets

- Ex. Interest payments on US owned Brazilian bonds - interest payments on German owned US Treasury bonds

- Net Transfer (unilateral)

- Foreign aid ---> Debit to current account

- Ex. Mexican migrant workers send money to family in Mexico

Capital/Financial Account

- The balance of capital ownership

- Includes purchase of both real and financial assets

Relationship between Current and Capital Account

- The current account and capital account should zero each other out

- Current Account has negative balance (deficit), Capital Account should have positive balance (surplus)

Official Reserves

- The foreign currency holdings of the U.S. Fed

- When there is a balance of payments surplus the Fed accumulates foreign currency and debits the BOP

- When there is a balance of payments deficit the Fed depletes its reserves of foreign currency and credits the BOP

- Official Reserves zero out the BOP

Active v. Passive Official Reserves

- ex.The U.S. is passive in its use of official reserves. It does not seem to manipulate the dollar exchange rate

- ex.China is active in its use of official reserves. It actively buys and sells dollars in order to maintain a steady exchange rate with the U.S.

I love all the pictures and visuals you added to your posts. They make your notes easy to understand and better absorbed by visual learners such as myself. i feel as though you are missing a little bit from your notes.Such as the things that are included in current and capital account. Other than that, your notes are spot on!

ReplyDelete