- Key Players: Adam Smith, John B. Say, David Ricardo, Alfred Marshall

- Supply creates its own demand (whatever output is produced will be demanded

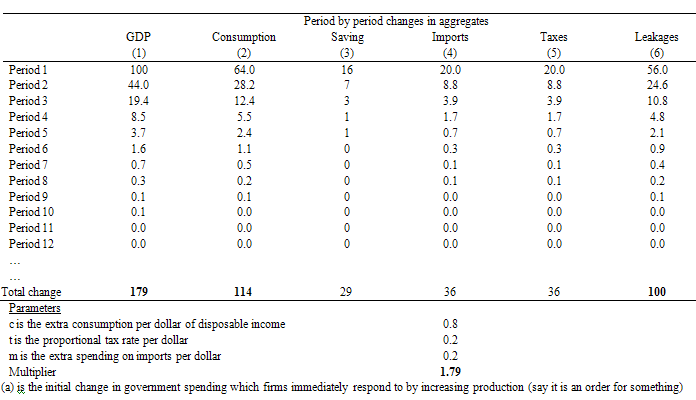

- Savings are leakages

- Investments are injections

- Aggregate Supply determines output

- "Invisible Hand" - Where market functions by itself, no government intervention (laissez-faire)

- Savings increase with the interest rate

- Aggregate Supply = Aggregate Demand at full employment equilibrium

- In the long-run, the economy will balance at full employment

- The economy is always close to or at full employment

- "Trickle-Down Effect" - Help the rich first, and the poor will benefit later. Much later.

- Prices and wages are flexible downward

Keynesian

- Savers do not equal investors

- Key Player: John Maynard Keynes

- Competition is flawed, Aggregate Demand is key, not Aggregate Supply

- Aggregate Demand determines output, demand creates its own supply

- Savers and investors save and invest for different reasons

- Savings are inverse to interest rates

- Leaks cause constant recessions

- Savings cause recessions

- Ratchet effects and stick wages block Say's Law

- Prices and wages are inflexible downward

- There is no mechanism capable of guaranteeing full employment

- In the long run, we're dead

- Economy is not close to or at full employment

- Some government intervention is needed

- Stabilizers

- Use expansionary/contractionary policy

- Fiscal policy

- Key Players: Alan Greenspan, Ben Bernanke

- Fine-tuning is needed

- Congress can't time the policy options

- Voters won't allow contractionary options

- Uses tight money and easy money

- Change required reserves if needed

- Buy and sell bonds on the open market

- Change interest rates for discount rate and federal fund rate